As the year ends, IBM has made a big splash announcement that its alliance with Apple has launched 100 different mobile apps basically for enterprises (with a few exceptions). MobileCloudEra began the year 2015 with articles about the Apple-IBM alliance and now is an appropriate time for a further assessment as we close out 2015.

Perspectives on the Apple-IBM Venture

There are a number of ways of looking at this joint initiative, which has begun to achieve meaningful scale. Among these are: Technique; Potential Economic Impact; Competition and Potential Competition.

As a summary, under Technique, we are most interested in an interview we had with IBM about their use of Apple’s Swift language and what that portends. Regarding Potential Economic Impact, we’ve tried to correlate the IBM offerings with data from the Bureau of Labor Standards (BLS) to gauge where the most dollars may reside and we find that to date the impacts are probably skewed towards two areas, Healthcare being the largest. Finally, we look at competition and consider the Red Hat-Samsung alliance the most direct competition, although in some areas, such as healthcare, there also are swarms of early stage companies that are going to have apps that compete with Apple-IBM.

IBM’s Growing Use of Swift for Mobile Apps Development

Technique. Of most interest is the December announcement by Apple that its Swift development language is going to be open source. IBM is taking a major role in popularizing Swift and, as the company puts it, “moving Swift to the enterprise.” (Swift is a general purpose programming language, which “is intended as a replacement for C-based languages (C, C++, and Objective-C)” See: swift.org).

We had the opportunity to speak with John Ponzo of IBM, (IBM Fellow, VP and CTO of IBM MobileFirst) about Swift and IBM’s plans. He told us that IBM had started using Swift in early 2014. He stated that they are building a “big team of thousands of Swift developers.” They are, or will be, adding features including concurrency, Swift packages to simplify end-to-end development and cognitive capabilities linked to Watson.

They have developed an IBM Swift Sandbox to give developers the opportunity to experiment with Swift. Ponzo explained that MobileFirst includes: 1) MobileFirst for iOS; 2) MobileFirst Platform – IBM is a leader in offering applications development services (actually ranked highest in Gartner’s magic quadrant for this area) which can include its mobile backend as a service and other offerings; 3) a growing number of cloud services for developers.

Potential Impact of 100 Apps

Potential Economic Impact. IBM has stated that it now offers 100 apps for 14 industries and 65 professions. The concentration is on what Ponzo refers to as “industry professionals”. He explains that IBM has to blend deep industry and function knowledge with best of breed design expertise, the latter largely supplied by Apple.

The apps cut across a swath of industries. Based on analyzing Bureau of Labor Statistics (BLS) data, it appears that the job categories covered by these apps probably entail nearly a trillion dollars in compensation annually in the U.S. alone. (Several apps don’t track onto job categories, as listed by BLS.)

A number of observations stand out. A high percentage of this compensation is in the healthcare field, probably as much as 40%, primarily physicians and nurses. In addition, another large piece consists of retail salespeople.

Marketplace Results to Date

IBM has not, to our knowledge, given out any information on to how the apps, in total, or any specific apps, are faring in the marketplace. An IBM VP recently stated that, “The response from clients has been overwhelmingly positive.” Since so many of the apps are new to the market – only 32 had been released as of this past July – it is probably too early to make judgments about the likely success of most of them.

However, an indication of progress can be gleaned from Apple’s recent statements. Tim Cook recently stated that Apple’s enterprise business had totaled $25 billion for the latest fiscal year, an increase of 40% over the prior year and 10% of total Apple revenue (of $234 billion).

Apple also told an analysts’ earnings meeting that they are “very happy with the progress of our IBM partnership.” Apple mentioned customer engagements with Air Canada, National Grid in the UK and Banorte in Mexico. IBM has revealed that Air Canada is using the in-flight app (presumably “Passenger+”.) Apple stated that it had “over 500” enterprise customer engagements.

Another offshoot of the Apple-IBM venture has been apps that IBM lists under the heading of “Aging.” These are related to an initiative undertaken by the two companies with Japan Post Group – Japan having perhaps the world’s most severe problem of aging population. The apps deal with issues related to caring for elders who are at home. They provide accessibility to family, caregivers, medical professionals and information. Apple stated earlier this year that Japan Post expected 4-5 million users by 2020, and that other countries had expressed interest in the offerings.

Type of Impacts

The targeted impacts of the apps fall into two main categories: a) Cost Savings, or b) Revenue Enhancement. Closely related to Cost Savings is Productivity Improvement, which is essentially another way of looking at saving costs, i.e., getting the most results from your costs. And related to Revenue Enhancement is Customer Retention, i.e., if you lose the customer you lose their revenue.

For example, as we looked across seven apps that IBM lists for the airline industry, the intended benefits range across the categories listed above. Plan Flight, an app for enabling pilots to make efficient fuel requirement decisions is clearly aimed at a major potential cost savings benefit. Other apps in the Pilot Suite are aimed at increasing pilot productivity, by making information for flight planning more easily accessible.

On the other hand, an app for the crew, Ancillary Sale is designed to increase on-board sales, such as food and beverage, to passengers, using “predictive analysis.” Various apps for terminal-based airline agents appear to be aimed at enhancing the customer experience in the terminal and increasing the agent’s productivity.

Competition: Microsoft, Google, Red Hat-Samsung

Competition. The “usual suspects” as competitors are led by Microsoft and Google. Microsoft, through its Enterprise Mobility Suite is focusing increasingly on individual enterprise users. The Suite’s emphasis is on user identity and security issues and device management. We have not heard of an apps program that rivals the IBM one, however, Microsoft states that it does link to “hundreds of apps” and that it offers easy portability of apps across devices.

While Google offers Google Apps For Work, these are focused on generic capabilities such as email, cloud storage, collaboration, etc. Google has also begun offering its own recommendations of business apps in its Google Apps Marketplace, a program called Recommended for Google Apps for Work. However, we have not seen a job-focused mobile apps program from Google.

The most direct competitor to the Apple-IBM venture is the alliance announced by Red Hat and Samsung. Red Hat is establishing a Mobile Applications Platform that will offer: “A series of enterprise-ready industry-specific mobile applications that will run on the Red Hat Mobile Application Platform and address key workforce management and business tasks, such as business intelligence, field and customer service, inventory management and sales catalog, pricing, ordering, and invoicing.”

So the Red Hat products are intended to be directly competitive with Apple-IBM. Red Hat will also promote a developer ecosystem and offer support services. Samsung and Red Hat will jointly market the services. The apps will obviously run on Android, but Red Hat will also support other operating environments.

Conclusions – Decline of BYOD, Other Factors

We emphasize that it is early in the cycle for these apps, so that definitive judgments must await more experience. We are impressed that Apple has stated such a positive view of the relationship. Apple also mentioned that they would continue to rely on IBM, and other partners, for growth of penetration of the enterprise market. Even though he characterized enterprise as “a major growth vector for the future,” Tim Cook stated, “I do not envision Apple’s having a large enterprise sales force.”

It appears that the relationship will remain stable for some time, since each party still has a lot to gain. IBM is searching for revenue growth and a means to tie together diverse pieces of a mobile strategy. Apple is getting a big boost in its penetration of enterprises through IBM’s product development and marketing efforts.

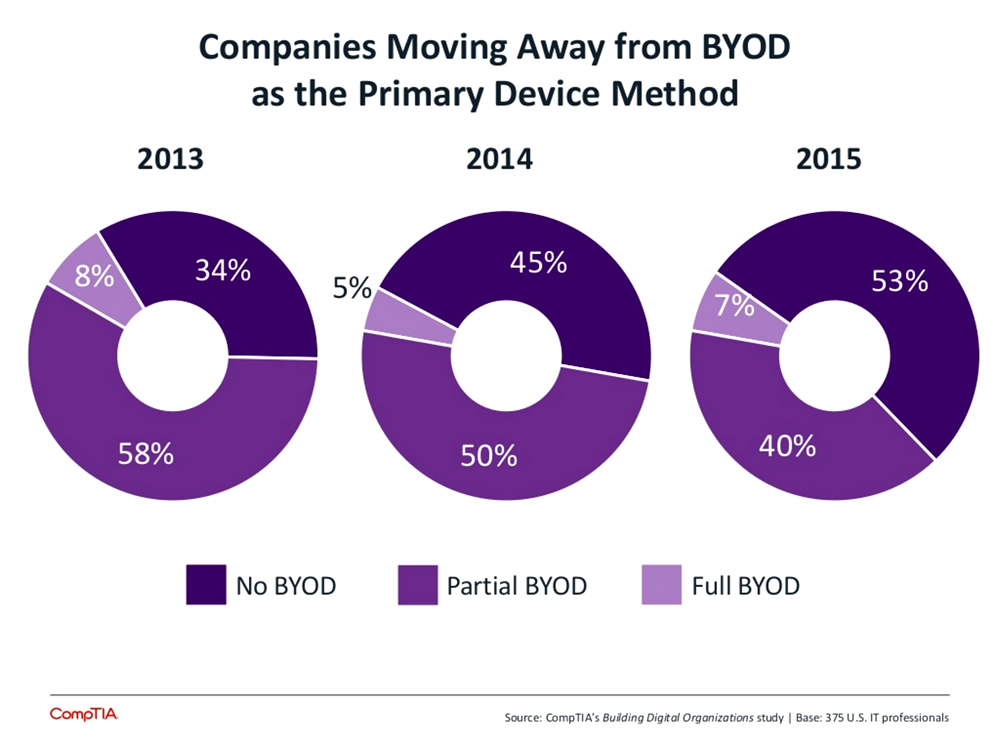

Another development, which we believe will work to Apple’s (and IBM’s) benefit is the declining support for BYOD in enterprises. A recent survey from CompTIA (Computing Technology Industry Association) found that 53% of companies surveyed did not allow BYOD at all. The results were summarized in the following chart from CompTIA.

We believe that Apple is well positioned, if this trend against BYOD continues, because it has provided for device compatibility and portability in the cloud. As one example of a major company ordering devices for its employees, Apple had mentioned earlier this year that United Airlines had not only added 10,000 iPad Air 2s, but also decided to “provide iPhones to over 20,000 flight attendants.”

We assess enterprise worker requirements as: 1) an app, preferably tailored to the worker’s function, 2) a device that displays the app in a uniform way, across what may be a widely diverse (geographically) workforce; and 3) cloud capability.

We believe that a large number of enterprises will find it daunting to supply apps that work across diverse devices for specific job functions. This helps account for the above-stated reluctance to embrace BYOD.