Neustar emerged in the late 1990s as the company chosen to administer the directory of numbers for number portability. Spun out of Lockheed, it became an independent clearinghouse for a number of services to telecom carriers, including: managing telephone area codes and numbers, and routing of calls and text messages.

Over the past few years Neustar has developed an Enterprise Services business, about 25% of its 2011 revenue, with the remainder being overwhelmingly Carrier business, as well as an Information Services segment. The Information Services segment, based on its acquisition of Targusinfo, discussed below, should become a significant part of its revenue stream (Update: the segment was 19% of total revenue in 2012.)

The company describes its major skillset as offering “addressing, routing, policy management and authentication services that enable our customers to find their end users, route network traffic to the optimal location and verify end-user identity.”

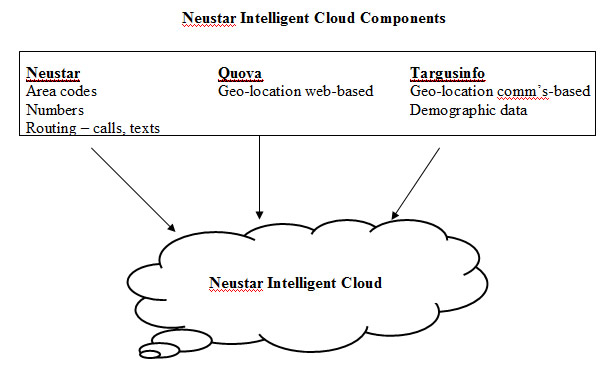

The company has developed the Neustar Intelligent Cloud. This appears to be a platform which enables clients to draw on Neustar’s unique database capabilities and build applications for mobile users.

As part of its mobile cloud strategy Neustar made two significant acquisitions. First it acquired Quova in late 2010. Quova offered software, and later a web-based service, that helped companies and organizations determine the geographic location of their website visitors. It claimed to perform 95% of such searches. Quova stated that its services allowed clients “to improve search results, fight online fraud, regulate digital content, and deliver geographically targeted advertising.”

In late 2011, Neustar acquired TARGUSinfo for $658 million. Targus became the basis of Neustar’s Information Services segment. Targus’ annual revenues, prior to acquisition were reported as about $150 million. Targus specialized in a number of communications-related data provision or CNAM (calling name) businesses, starting in the ‘90s with providing geographic location information (longitude/latitude) on callers to business clients. It later came to dominate the provision of caller ID info to the cable and independent VoIP providers.

Targus also sweeps 200-300 mainly publicly available information sources as well as certain ones that it has exclusive agreements with, for data, on individuals and households, such as household income, home owning status, property value, number of children and other items and provides this to its clients integrated with its caller ID services. Targus has done extensive analytics on this demographic data and identified a large number of affinities and behavior patterns (purchase behavior, media preferences, etc.)

Neustar’s emerging mobile cloud strategy appears to revolve around combining: 1) the traditional resources of Neustar, with its wealth of database info based on communications, with 2) the web-oriented geo-location services of Quova and 3) the communications-oriented geo location services and demographic data of Targusinfo and offering this combination through its Neustar Intelligent Cloud platform.

Neustar Intelligent Cloud Components

[lightbox type=”image” src=”https://www.mobilecloudera.com/wp-content/uploads/2012/09/Neustar-1.jpg”] [/lightbox]

[/lightbox]

Neustar states that its Intelligent Cloud “interconnects everything into a single, secure portal for managing communications, network features, and payment across multiple platforms.” It further asserts that its clients can use the platform to “deliver scalable solutions that are “optimized” for mobile through one provider, one agreement, one connection. Neustar provides simple web based REST APIs that bring together many mobile services and subscriber information, such as location, messaging, and mobile intelligence, across leading operators and partners in the US and Canada.”

Neustar is ready to plunge into a world of information services, particularly those that have a root in communications, location and demographic data and that can be provided efficiently through the cloud – with the emphasis, of course, on reaching the mobile user.

The company comes to this area with abundant experience in certain aspects that it believes will be quite valuable, for example, in the area of user consent and privacy protection. The company’s heritage is as a neutral trusted third party provider of information that is vital to and shared among competitors, particularly telecom carriers. It therefore has been in the role of “privacy arbiter,” understanding the requirements of privacy protection, e.g., is revealing the location of a phone a one-time or ongoing activity, consented to by the user (and if it is ongoing, is there a frequency limitation on passing the information.)

The company has been a supporter of OneAPI, the GSMA-sponsored initiative to simplify application development by cooperatively enlisting mobile and other carriers to allow various network information and capabilities to be exposed to and employed by Web application developers.

However, Neustar emphasizes that its customer base increasingly is not focused solely around carriers. It is seeking to widen its base of developers, retailers and other enterprises as clients. It believes that in addition to its own cloud, it can help third parties get apps approved by carriers, because of its intimate relationships with carriers.

However, its primary direction in cloud services is to establish the Neustar Intelligent Cloud as a resource for developers that is complete within itself.

Neustar sees its direction as becoming identified as an expert company in information analytics and delivery. It will continue to provide discrete services to carriers and enterprises and its common thread will be connecting people. However, it will continuously enrich the information content of its services and use the Intelligent Cloud to enable its and other parties services and as a social platform.

The company already has a redundant network with two data centers, 150 end points (IP peering points around the world), a NOC, large Oracle databases (for services such as number portability and routing) and redundant fiber. Carrie inquiries, “dips,” come in at the rate of 30 billion per day.